What is GASB 87 and how IBM TRIRIGA can help Government Agencies stay compliant

The Governmental Accounting Standards Board (GASB) was established to develop the accounting and reporting standards to contribute to fostering visibility and transparency in financial reporting across Governmental entities. This accounting standard also allows Government Agencies to stay accountable to the benefit of the taxpayers and investors.

What Is the Purpose of GASB?

GASB helps review the existing accounting standards and also helps establish new ones for the benefit of the users. Furthermore, this board hosts discussions, speeches, and roundtables. They also issue user guides to help taxpayers understand financial statements.

What is GASB 87?

GASB-87 is the latest lease accounting standard for governmental entities, effective for reporting periods beginning after June 15, 2021 (June 30, 2022, audits will be considered first).

This accounting standard establishes a single model for lease accounting based on the foundational principle that leases are financings of the right to use an underlying asset. Herein, a lessee is required to recognize a lease liability and an intangible right-to-use lease asset, and a lessor is required to recognize a lease receivable and a deferred inflow of resources. This helps enhance the relevance and consistency of information about governments' leasing activities.

Governmental entities are required to:

- Consolidate their lease agreements (lessee and lessor - copiers, vehicles, real estate, water tower, cell lease, among others)

- Test each agreement to determine whether they are subject to the reporting requirements

- Calculate lease beginning balances and schedules

- Update their financial statements and note disclosures with this new information

Who Does GASB 87 Matter To?

GASB-87 is the latest lease accounting standard for government entities (specifically State and Local government agencies, Public Hospitals Higher Education, and Healthcare providers).

How Can IBM TRIRIGA Help with GASB 87 Compliance?

IBM TRIRIGA provides a complete solution that helps Governmental Agencies accelerate GASB 87 compliance and real estate portfolio performance.

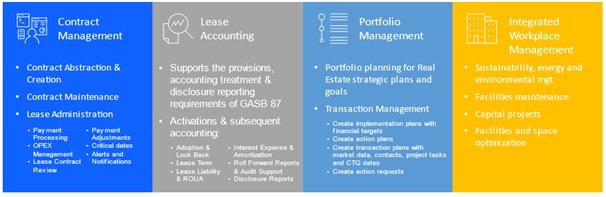

IBM TRIRIGA provides:

- Lease Management executives comply with and administer GASB 87 standards

- Real Estate executives’ chart and transform the future course for their agency

- A system of record repository to manage real estate and asset lease contracts

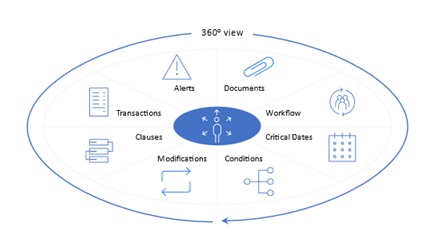

- A 360-degree repository containing lease history, metadata, and documents with workflow. This is important for contract management and regulatory compliance.

Offers a holistic real estate management solution that provides the following:

- Pre-built data structures and processes for all types of leases

- Ability to compare financial and non-financial returns.

- Easy integration with financial and other critical systems.

- Alerting capability required for lease accounting reviews.

- Ability to identify underperforming and under-utilized facilities.

- Automated lease accounting controls.

- Modeling capabilities for alternative planning scenarios.

- Audits decisions, approvals, and processes.

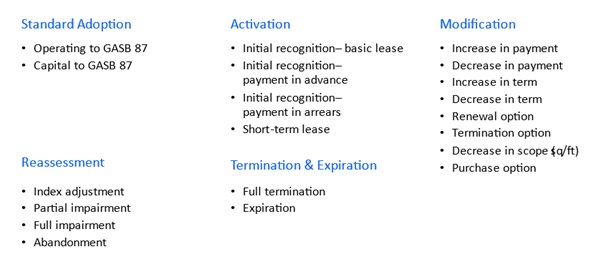

It provides the following support for GASB 87 compliance scenarios:

The GASB 87 functionality in IBM TRIRIGA covers:

- Terminology

- Lease Classification

- Determining and Reassessing Lease Term

- Transitioning existing Capital and Operating Leases

- Initial Recognition and Subsequent Accounting

- Remeasurements and Reassessments

- Impairments

- Index Adjustments

- Terminations and Expirations

- Disclosure Reporting

To add on, in a government lessee, the lease accountant can apply the required accounting treatment in IBM TRIRIGA.

- At the commencement of the lease term, the lessee recognizes a lease liability and an intangible right-to-use lease asset (lease asset). The lease liability will be measured at the present value of payments expected to be made during the lease term.

- Lease payments will result in the reduction of the lease liability and recognition of interest expense

- The lease asset will be measured as the sum of the initial measurement of the lease liability, initial direct costs, and lease payments made before commencement, less any lease incentives.

- The lease asset will be amortized over the shorter of the lease terms or the useful life of the underlying asset.

As regards transition to GASB 87, the statement requires that leases are recognized and measured using the facts and circumstances that existed at the beginning of the period of implementation. If applied to earlier periods, leases are recognized and measured using the facts and circumstances that existed at the beginning of the earliest period restated.

The cumulative effect, if any, of applying this statement is reported as a restatement of the beginning net position (or fund balance or fund net position, as applicable) for the earliest period restated.

About Quantum Strides:

Quantum Strides LLC is a leader in Integrated Workplace Management Solutions (IWMS) space specializing in solutions for Real Estate and Asset management (including Lease Management), Capital Projects, Space & Move management, Operations & Maintenance and Sustainability Solutions. Headquartered in the Washington DC metro area Quantum Strides has a workforce in the United States, Canada and India helping us serve our clients across diverse geographical regions. We are a partner of choice for several Fortune 500 clients, Government entities and large System Integrators.

Learn more about us at: www.quantumstrides.com

We have been helping clients with lease accounting compliance and portfolio management for several years. If you are looking for assistance, feel free to email us at iwms@quantumstrides.com or contact us for more information.

WRITE A COMMENT